Standard Deviation is a statistical measurement of volatility.

It measures how widely values range from the average value. The larger the difference between the closing prices and the average closing price, the higher the standard deviation will be and the higher the volatility. The closer the closing prices are to the average price, the lower the standard deviation and the lower the volatility. High volatility levels can be used to time trend reversals such as market tops and bottoms. Low volatility levels can sometimes be used to time the beginning of new upward price trends following periods of consolidation.

Standard Deviation is generally used as a component in the calculation of other indicators.

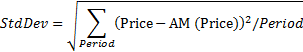

Calculation:

AM= Arithmetic Mean

|

This indicator is valid only in MyChart. |

Inputs:

Security = XU100

Start Day = First day of the date range

End Day = Last day of the date range

Currency

Indicator Type: Volatility